Budget 2024-25: A Comprehensive Guide for Individuals and Businesses

Ah, budget season! It's that time of the year when the nation collectively holds its breath, waiting to see how the government plans to allocate its resources. This year's Budget 2024-25, being an interim budget before the general elections, holds even more significance. But fear not, financial enthusiasts and curious citizens alike! This blog is your one-stop guide to understanding the key features of this budget and their potential impact on you.

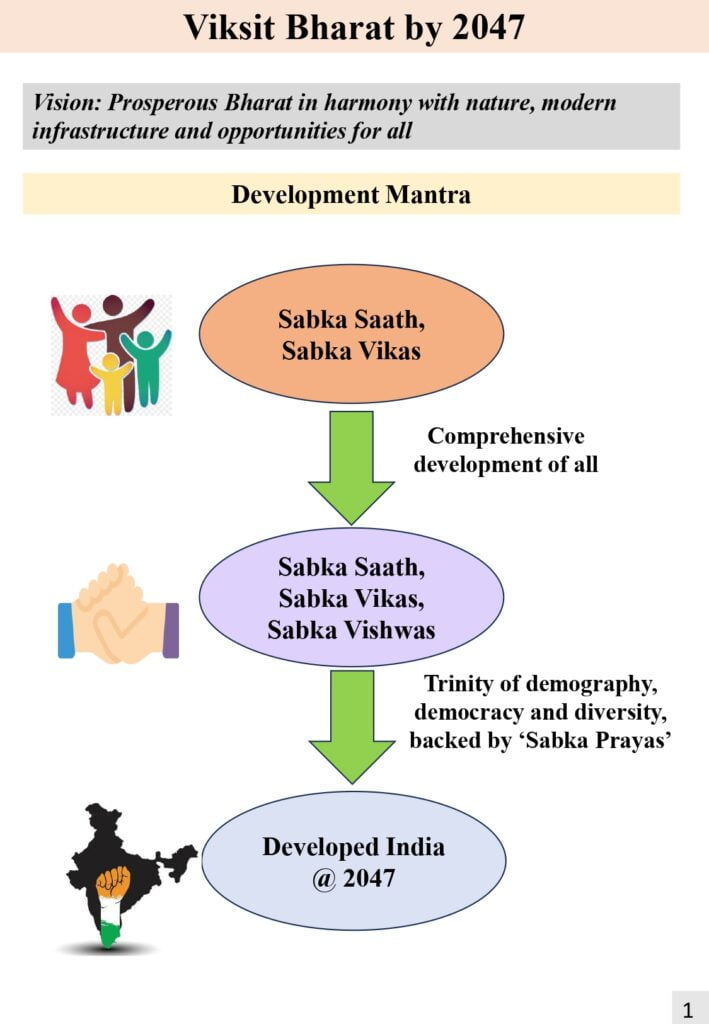

Viksit Bharat by 2047

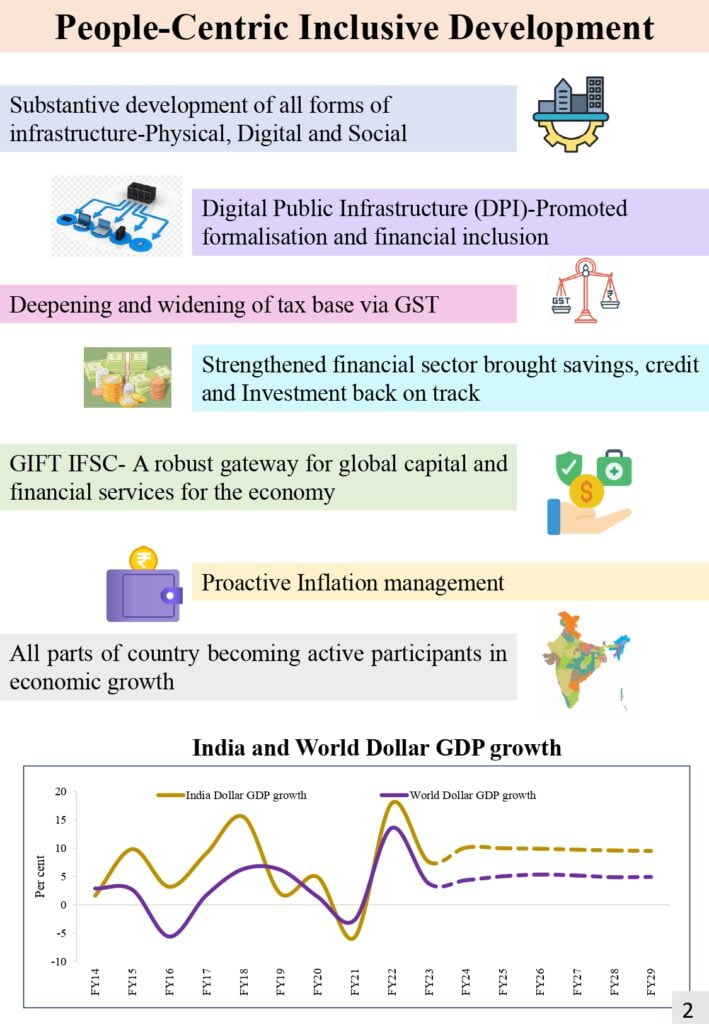

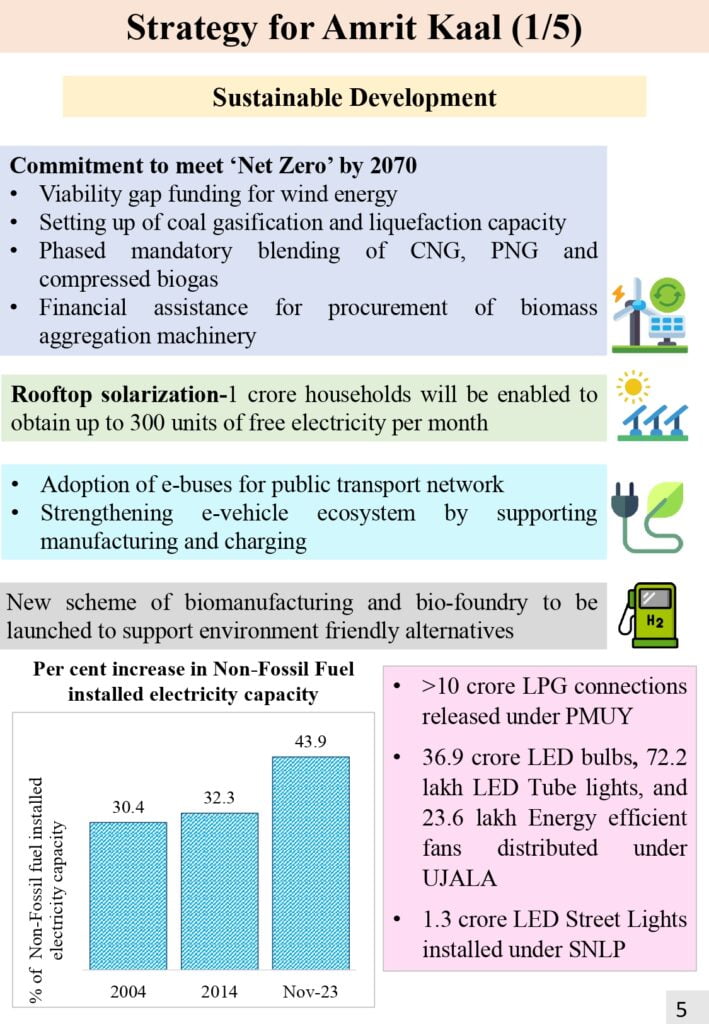

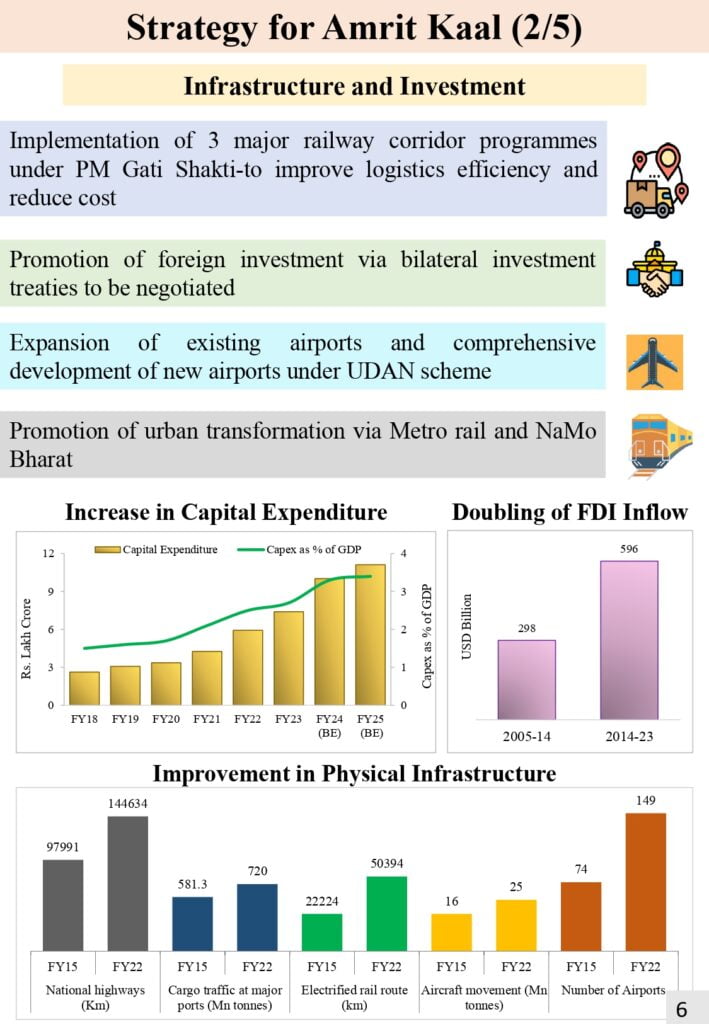

Focus on Infrastructure & Investments:

- The budget emphasizes boosting infrastructure development, allocating significant funds to roads, railways, and digital connectivity. This could create long-term benefits for businesses and job creation.

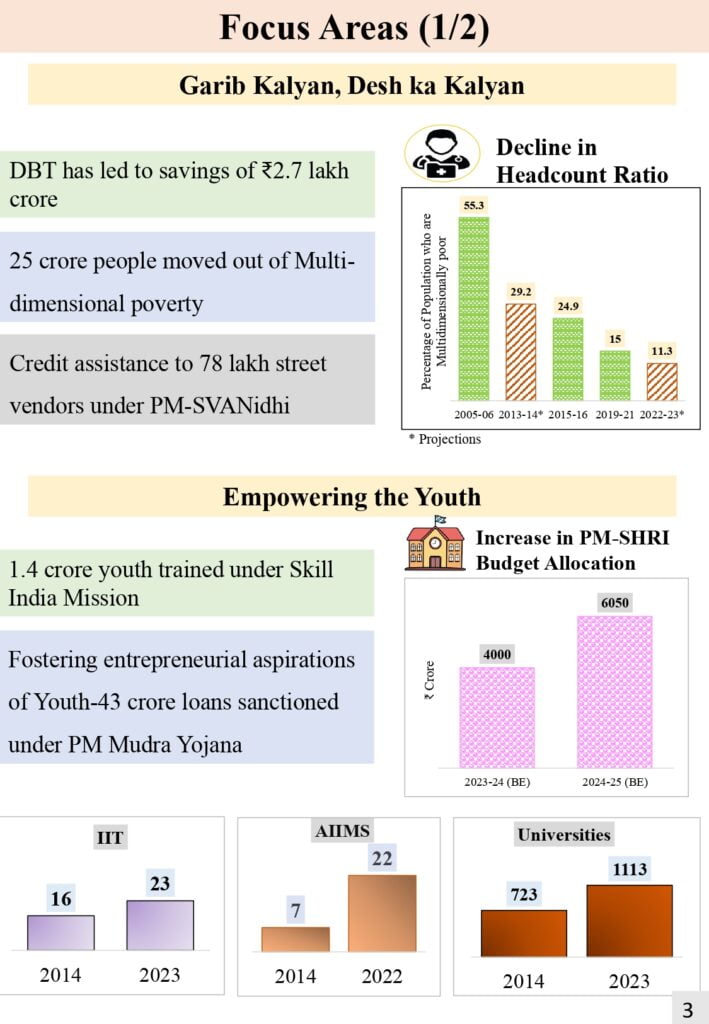

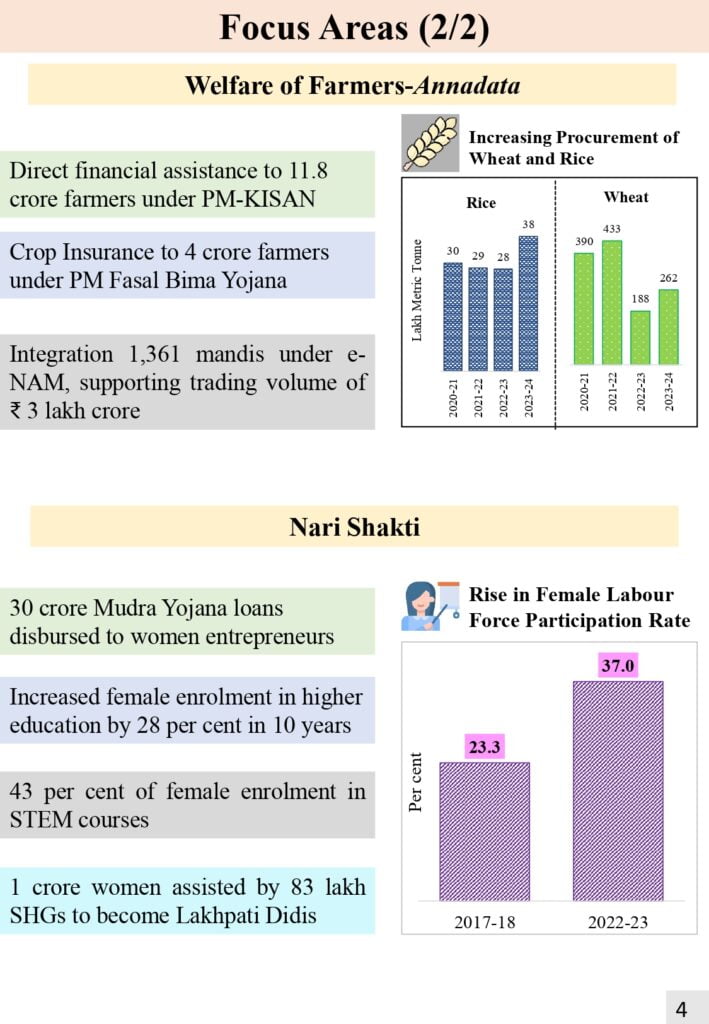

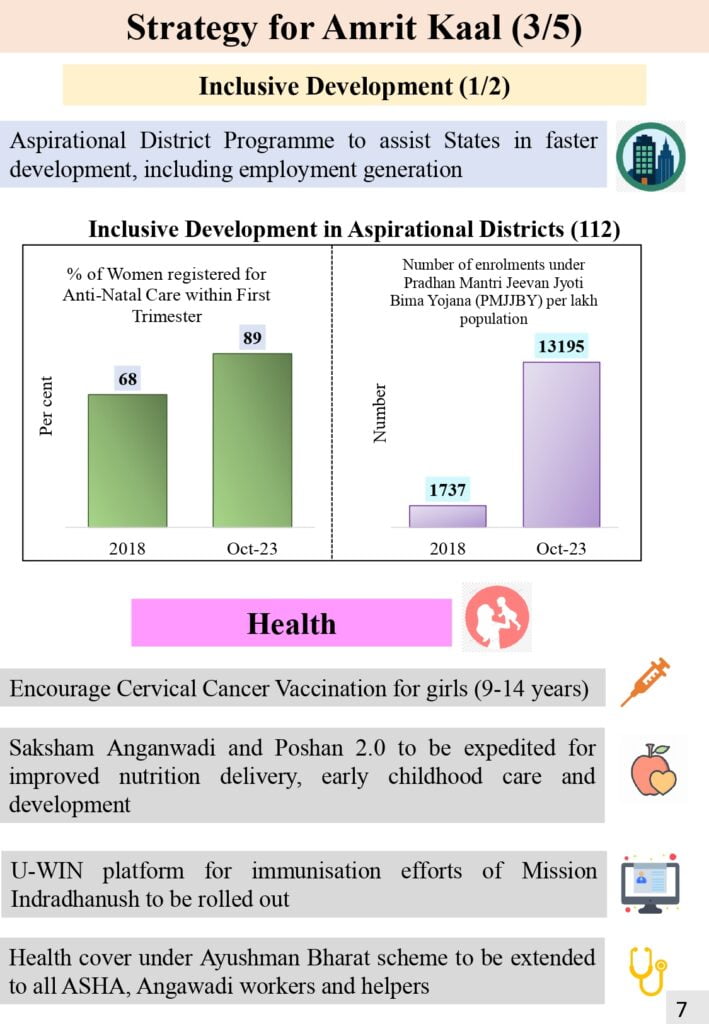

Boosting Rural Economy:

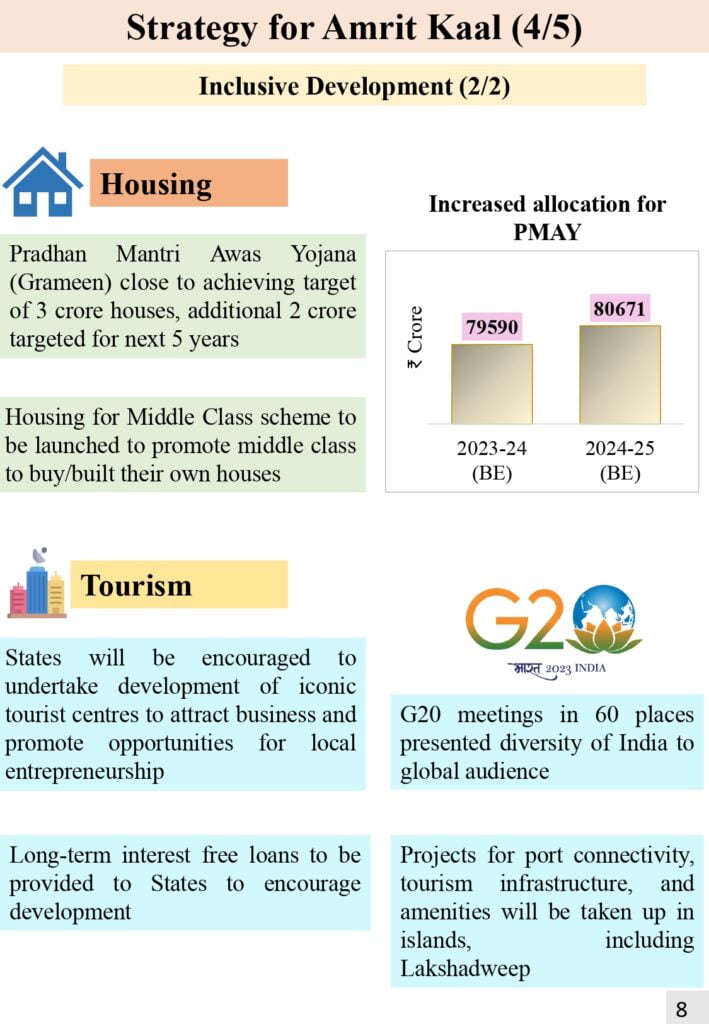

- Measures like additional housing under PMAY-G and increased agricultural credit aim to revitalize rural India, impacting millions of livelihoods.

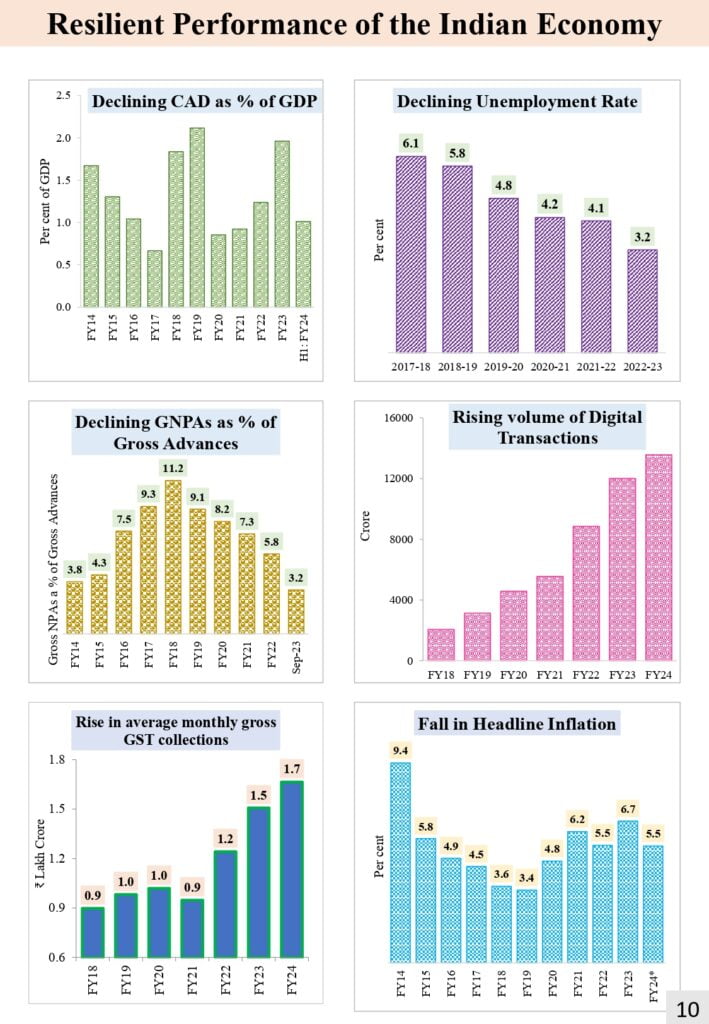

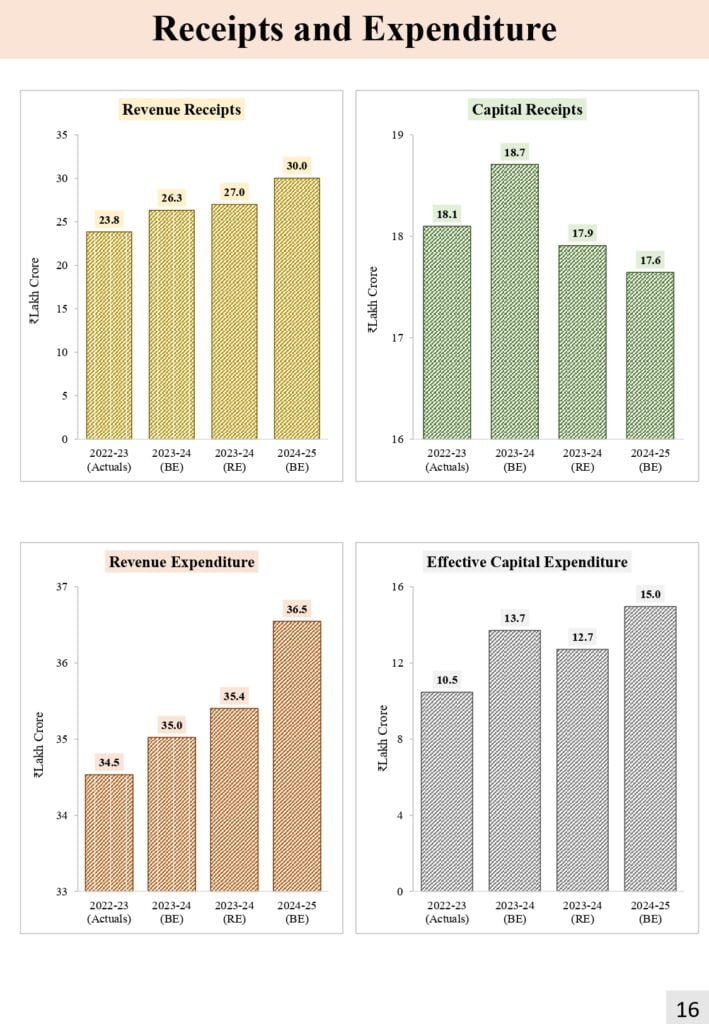

Fiscal Consolidation:

- The government aims to reduce the fiscal deficit, potentially impacting spending on social welfare schemes. Keep an eye on how this unfolds.

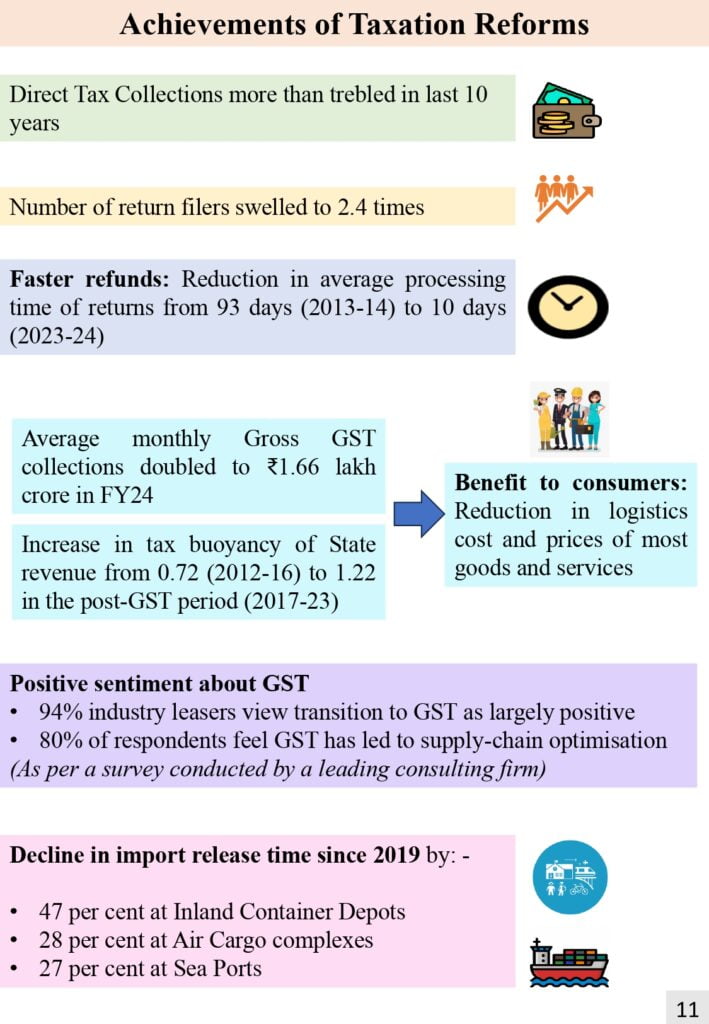

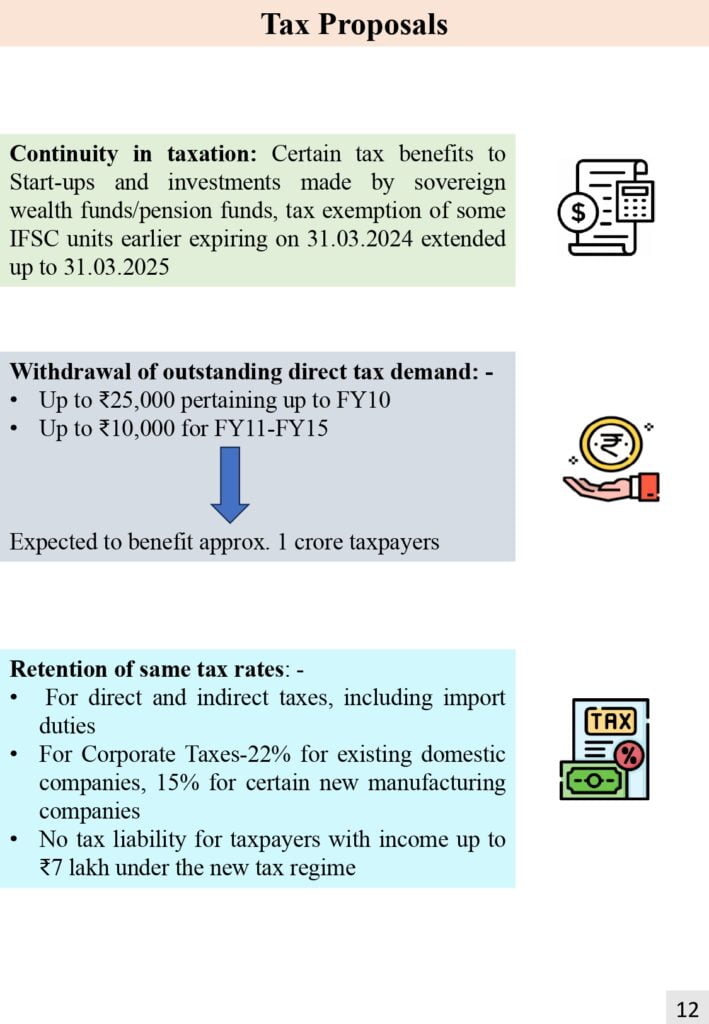

Taxation:

- While no major tax changes were announced, potential tweaks in the next full budget after elections could be on the horizon.

Impact on Different Sectors:

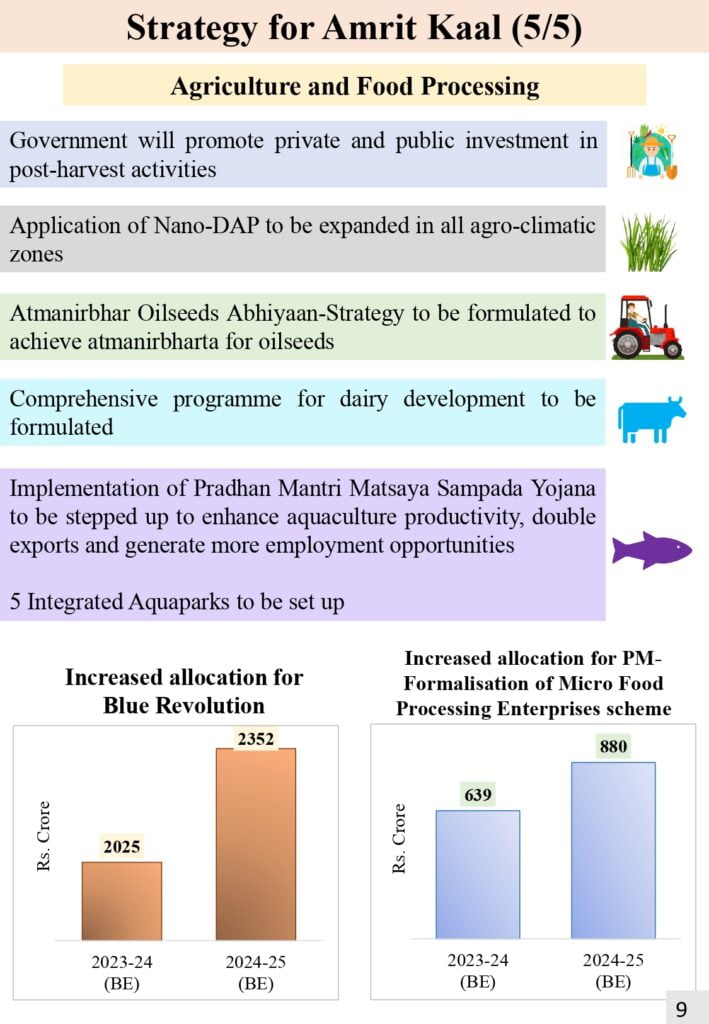

Agriculture:

- Increased credit access and focus on rural development could bolster agricultural output and income.

MSMEs:

- Initiatives like credit guarantee schemes and skill development programs aim to empower small businesses.

Infrastructure & Construction:

- Increased spending on infrastructure projects could spur growth in this sector, creating job opportunities.

Financial Services:

- Focus on digitalization and financial inclusion could benefit fintech startups and the banking sector.

Making Informed Decisions:

Individuals:

- Analyze potential changes in tax slabs, deductions, and investments to plan your finances strategically.

Businesses:

- Evaluate how infrastructure development and sectoral focus areas align with your business goals and adapt your plans accordingly.

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Tagged Budget2024, business, Economy, Finance, FuturePlanning, governmentofindia, India, indiabudget, Investment, keyfocus, unionbudget