Final Practice Booster – Marvel Paper 13 Section B

Introduction

The Marvel Paper 13 Accounting Section B Solutions GSEB 2026 is a powerful final-stage preparation tool for students appearing in the GSEB 12th Commerce board examination scheduled between February and March 2026. As the exam date gets closer, students need structured and exam-oriented practice papers that help refine accuracy, speed, and presentation skills.

Section B in Accounting carries significant weightage and focuses mainly on practical numerical problems. Students who master this section often secure higher overall marks. By consistently practicing with Marvel Paper 13 Accounting Section B Solutions GSEB 2026, students improve their confidence in solving partnership adjustments, company accounts, financial statements, and accounting ratio problems.

At this stage of preparation, it’s not just about understanding concepts — it’s about perfecting performance.

Why Marvel Paper 13 Accounting Section B Solutions GSEB 2026 Is Important

Section B generally includes high-scoring chapters such as:

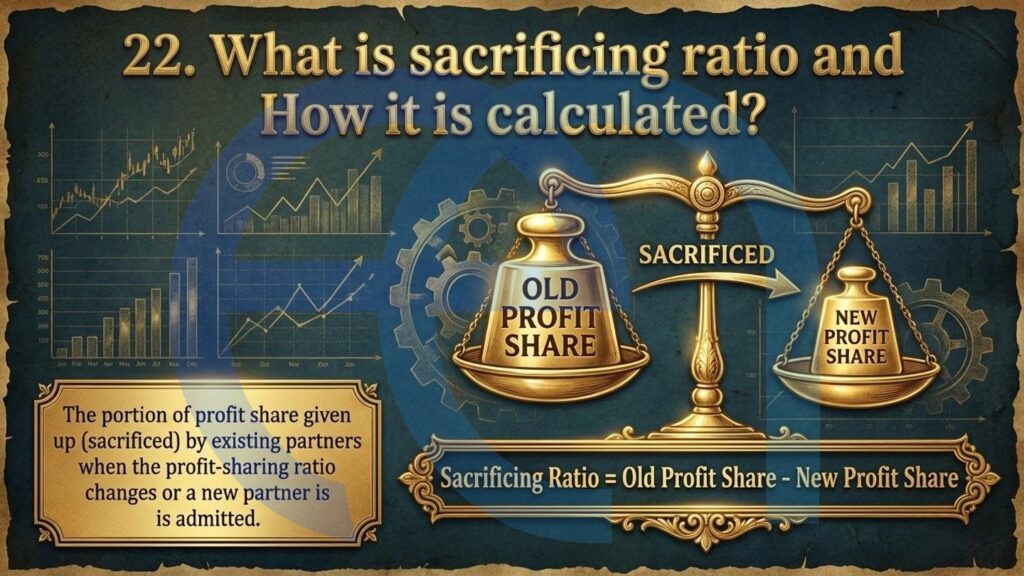

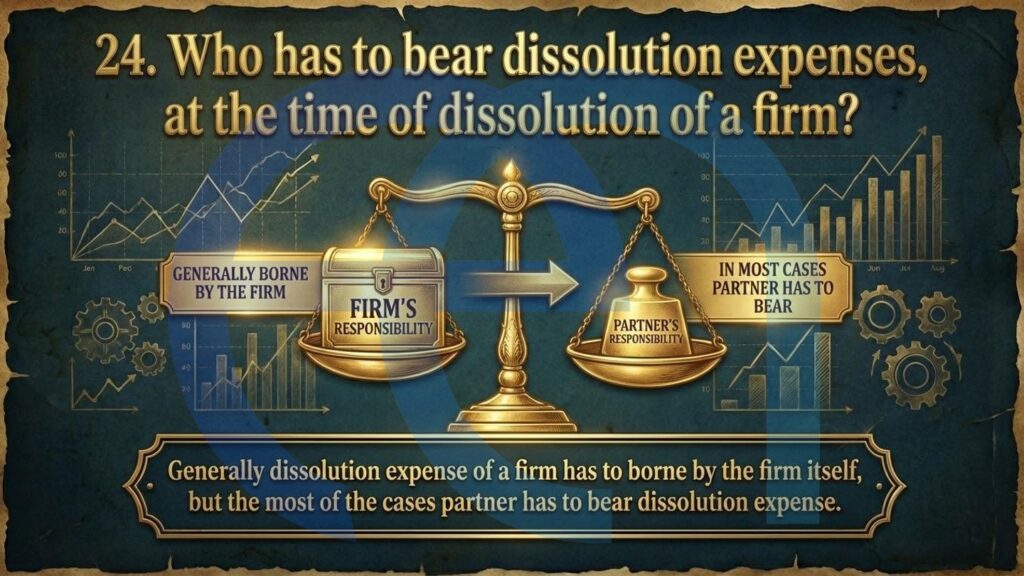

Partnership Accounts

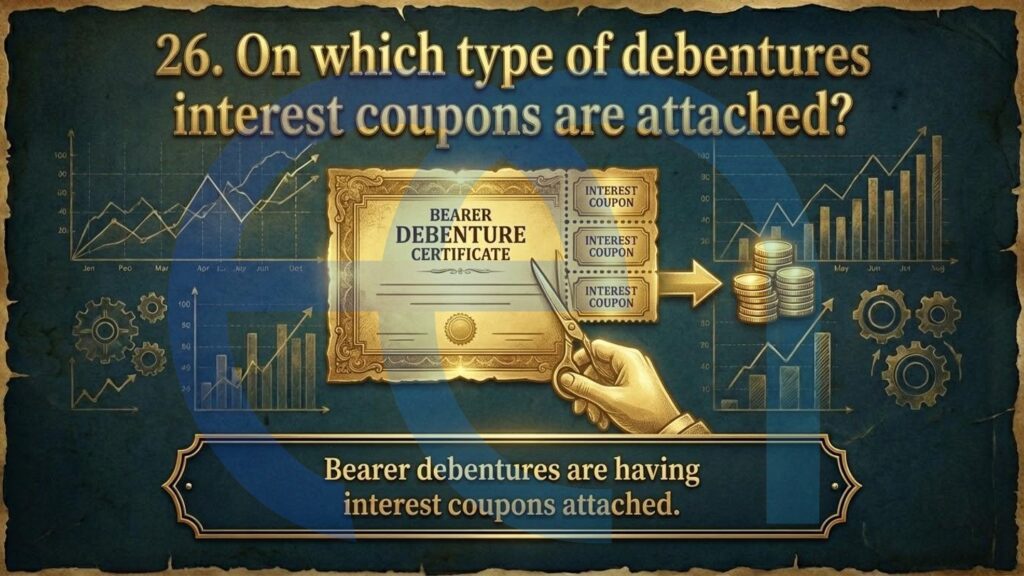

Company Accounts

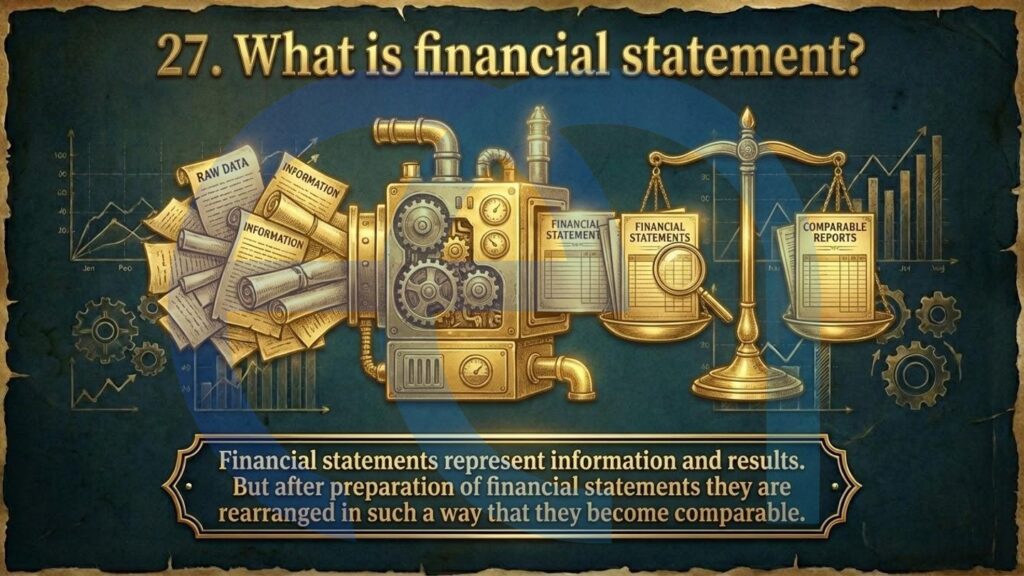

Financial Statements

Accounting Ratios

These topics demand logical thinking, structured formatting, and precise calculations. Many students lose marks due to:

Skipping working notes

Incorrect adjustment treatment

Poor presentation of balance sheets

Missing journal narration

Mismanaging time during lengthy sums

Practicing Marvel Paper 13 Accounting Section B Solutions GSEB 2026 helps students eliminate these errors before the final exam. The step-by-step solutions demonstrate how answers should be presented according to board evaluation standards.

Repeated revision strengthens clarity and reduces careless mistakes.

Question Pattern and Marks Distribution Analysis

Understanding the structure of Marvel Paper 13 Accounting Section B Solutions GSEB 2026 helps reduce exam anxiety and improve strategic preparation.

Section B typically contains:

Long practical problems with multiple adjustments

Revaluation account and capital account preparation

Share capital and forfeiture entries

Financial statement preparation

Ratio calculation and interpretation

Marks are awarded for:

Proper headings and format

Working notes

Logical adjustment entries

Step-wise calculations

Final presentation

Even if the final balance does not perfectly match, step marking ensures students receive partial marks. This is why systematic practice is extremely important.